Remuneration Policy

About Nordea Funds Ltd's Remuneration Policy

Nordea Funds has adopted the remuneration policy of Nordea Group with fund management company regulation specific adjustments.

Read more

The portfolio management of Nordea’s Nordic-domiciled funds is outsourced to Nordea Investment Management (NIM).

Nordea Investment Management (NIM) is based in the Nordic countries and attends to the portfolio management of Nordea’s Nordic-domiciled funds. In addition, NIM takes care of the individual asset management of institutional clients in our funds.

Surveys completed by institutional clients have indicated that NIM is among the best asset managers in the Nordics. According to the findings of these surveys, institutional clients consider NIM's international expertise and investment services to be of high quality.

NIM is a part of the Nordea Group and has the entire group's investment expertise and resources at its disposal. Around 250 investment specialists work at NIM ensuring that the portfolio management of our funds meets all expectations.

NIM's extensive international organisation allows for the portfolio managers to specialise in different sectors, such as small- and medium-sized enterprises or high-yield corporate bonds. This is also reflected in our broad range of specialised investment funds.

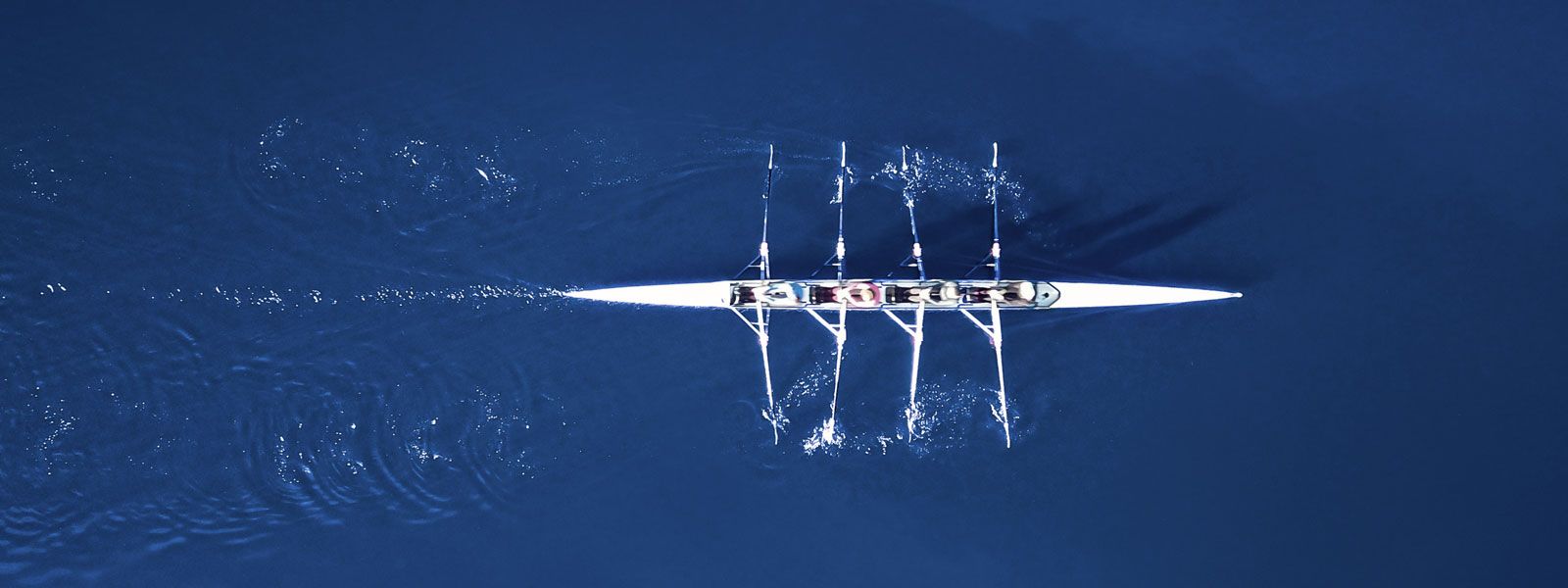

NIM's operating model has been fine-tuned through determined and long-term teamwork. Selecting investments for the funds is a lengthy process – portfolio managers make investment decisions based on extensive research and analysis covering different sectors and companies across the world.

Remuneration Policy

Nordea Funds has adopted the remuneration policy of Nordea Group with fund management company regulation specific adjustments.

Read more

Active Ownership

Nordea Funds Ltd* has already exercised active ownership on behalf of the funds it manages since 2001.

Read more